How Buying Expensive City Apartments Is a Financial Trap for Indians

For many Indians, owning a luxury apartment in a big city is sold as the ultimate symbol of success. Glass towers, gated societies, clubhouses, and prime locations are aggressively marketed as “dream homes.” However, for a large section of the middle class, buying crore-rupee apartments in metro cities often turns into a long-term financial trap rather than a wealth-building decision.

Instead of financial stability, many families find themselves locked into decades of EMIs, high living costs, and constant financial stress.

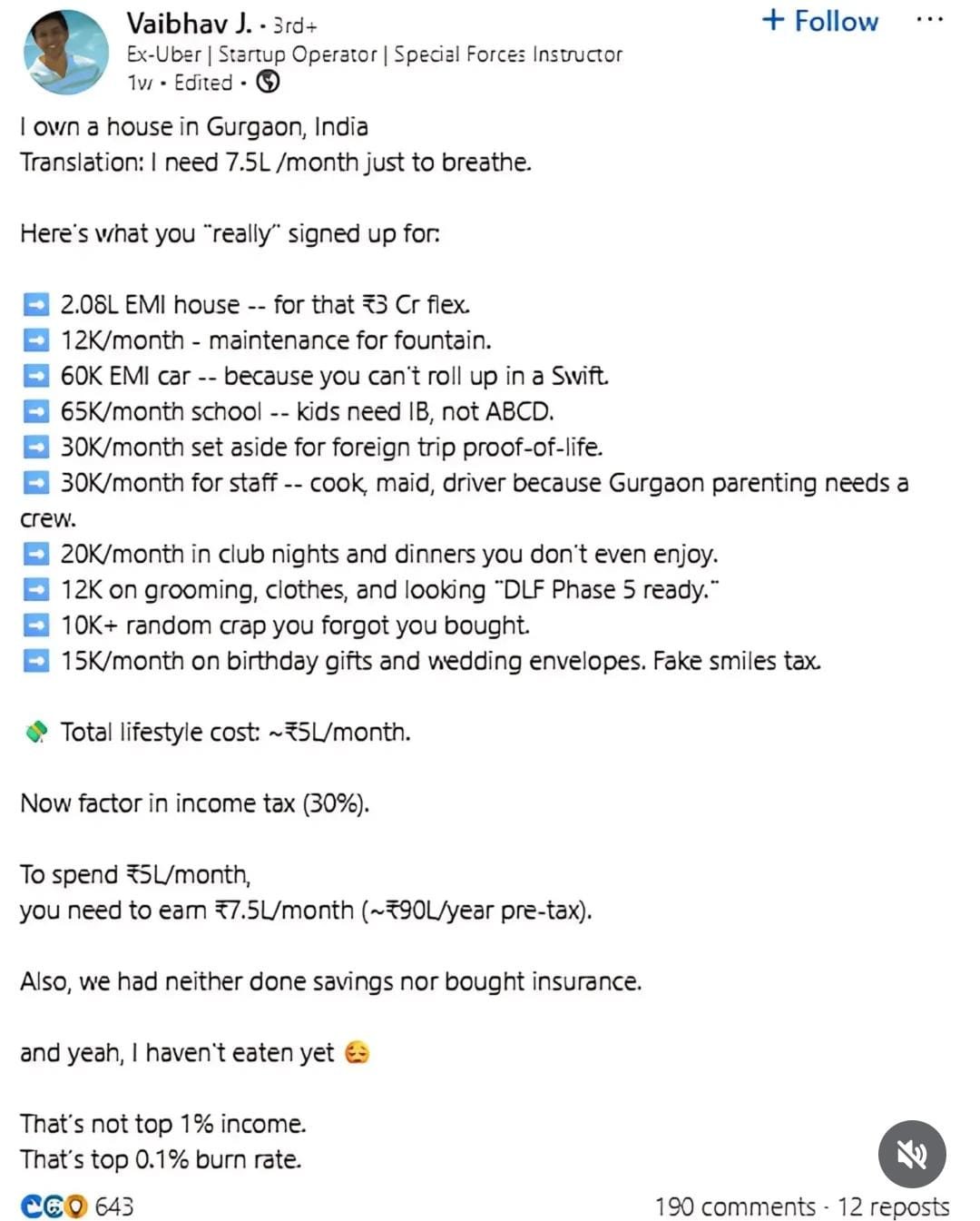

The EMI Trap of City Apartments

Most city apartments today are priced far beyond what an average salaried Indian can afford outright. This pushes buyers into long-term home loans lasting 20 to 30 years. A ₹1–2 crore apartment often ends up costing two to three times its original price due to interest payments alone.

A large portion of monthly income goes toward EMIs, leaving little room for savings, investments, or emergencies. Job loss, medical expenses, or economic slowdowns can quickly turn these EMIs into a crushing burden. Instead of financial freedom, families end up working only to service debt.

Poor Appreciation Compared to Cost

One of the biggest myths surrounding city apartments is that they always appreciate well. In reality, most apartments depreciate over time due to ageing buildings, maintenance issues, and oversupply. Unlike land, apartments are depreciating structures attached to a limited share of land.

In many metro cities, apartment prices have remained stagnant for years, while owners continue paying high EMIs, rising maintenance charges, property tax, and society fees. Rental income often fails to even cover monthly loan repayments, exposing the harsh financial reality behind premium city homes.

Hidden Costs That Drain Your Money

City apartments come with several hidden and recurring expenses. Monthly maintenance fees, sinking funds, parking charges, renovation costs, and frequent repairs silently eat into income every year. Add rising electricity bills, water charges, and city living costs, and the total ownership expense becomes far higher than expected.

Many buyers realise too late that their so-called dream home is locking them into a lifestyle they must constantly struggle to afford.

Why Buying Land or Homes in Towns and Rural Areas Makes Sense

Buying land or an independent home in a town or rural area is often a financially smarter decision. Land has historically appreciated better than apartments because it is limited and does not depreciate like buildings. There are no monthly maintenance charges, and ownership is simpler and more flexible.

Homes in smaller towns cost a fraction of city apartment prices. Buyers can build gradually, upgrade over time, or even remain debt-free. This allows money to be invested in businesses, mutual funds, education, or emergencies instead of being locked into EMIs.

Better Quality of Life and Financial Peace

Town and rural living often provide a better quality of life — more space, cleaner air, less congestion, and stronger community bonds. With remote work and digital infrastructure improving rapidly, living outside big cities is becoming increasingly practical.

Lower living costs translate into higher savings, better investments, and mental peace. Instead of working only to pay EMIs, families can focus on long-term financial security.

Final Thoughts

A crore-rupee city apartment bought on heavy debt is often a liability disguised as an asset. True wealth is built by owning appreciating assets with minimal debt. For many Indians, financial freedom does not come from luxury addresses but from smart decisions that reduce debt and increase ownership.

Before signing up for a lifetime of EMIs, it is worth asking one simple question: Are you buying a home, or are you buying a financial burden?